-

Drones in Supply Chain

Introduction –

Of all the systems involved in shipping and transportation services today, automated processes for delivery and logistics remain among the most critical. Looking at the future of shipping service providers as well as the future of drones is a fascinating aspect of the modern supply chain network. It all comes down to digitalization and automation.

The evidence of the increasing popularity of supply chain automation is pushing companies to research even more performant alternatives that will keep boosting the efficiency of robots inside supply chains. The many benefits that come with omnichannel logistics and automation are the reason why new and higher productive technologies are surging among high-tech drone companies.

According to the experts at Supply Chain Digital, “The potential for drones as powerful business tools is huge. For supply chains, drones can be used in warehouses to increase the accuracy and efficiency of inventory management through to last-mile delivery.” Big companies around the world have started to integrate drones into their supply chain over the past years to help manage their inventory.

The drones are designed to assist human workers indoors and benefit large organizations with stationary stock. Companies that deal with a large amount of inventory often find omnichannel logistics challenging when it comes to locating items inside the warehouse.

Therefore, aerial inventory drones can benefit many prominent organizations in finding the right items inside the warehouse and cutting their inventory carrying costs. The drones have sensors, scanners, and cameras to monitor and track inventory visibility and availability.

The aim of integrating this automated drone technology with delivery and logistics is mainly a concern with accuracy as drones should be more efficient and precise than humans. Additionally, camera drones can verify e-commerce deliveries and other milestones in real time without waiting for human intervention.

So far, implementing drones into supply chains has been great, and drones are becoming quite popular. This is largely due to their capability of flying around, avoiding obstacles, navigating indoors, and operate in fleets with direct distribution (Dronevideos.com, 2018). The collection of aerial data and navigational insight also helps boost the popularity of drones today.

Benefits of Drones- Delivery and Logistics

Several benefits can be identified while using indoor drones. First, the human workforce will potentially hold fewer hazardous tasks, and no ladder climbing or dangerous inspections anymore. There is a fast return on investment due to the manageable acquisition cost of hardware associated with this type of omnichannel logistics.

Secondly, the reliable/stable software can enable fully autonomous indoor navigation and automatically scan barcodes. Despite these promising positive effects that drones bring to a warehouse, many negative side effects regarding e-commerce solutions must be overcome. These include issues, such as inventory service costs and warehouse space management concerns, and more..

Limitations of Drones for Logistics

The limited flying area and the many obstacles inside the warehouse make the process complex. Furthermore, integrating the drones into the existing process makes it time-consuming and sometimes unsafe due to potential drones failures such as battery explosions. The maintenance and reparation costs also take into consideration resulting in some delays or downturns.

Analysis of direct distribution with drones has also shown that automated systems often suffer from the “garbage in,” and “garbage out” issues. When inventory gets lost, drones cannot prevent it, identify it, or resolve it. Despite all the benefits that drones can bring, a few adjustments still need to be studied, analyzed, and fixed to enjoy and operate the drones inside omnichannel logistics and automated supply chains fully.

Furthermore, the future might worry workers as they feel targeted and soon stand the risk of being replaced by more efficient and accurate drones (Maghazei, 2019). On the contrary, drones could also be an opportunity for workers to be trained and taught about new systems. They must know how to manage/supervise these drones and receive more specific assignments related to delivery and logistics. This will merely shift the work dynamic and prevent job loss and turnover within the global supply chain.

Limitations of Drones for Logistics

What the Future Holds for Omnichannel Logistics With Drones

Nowadays, automated supply chains are revolutionizing and reshaping the fulfillment process. The number of drones integrated inside warehouses into daily operations is booming. In general, technologies such as barcode labels, automated guided vehicles, automated storage and retrieval, and automated mobile robots are the near future for most global supply networks. These can aid in both forward and reverse logistics and keep the supply chain operating efficiently.

Despite the many benefits such as time-savings, increased accuracy, error reduction, cost-saving, better productivity, efficiency, and more space created, the human workforce is worried about their future as robots start to replace them.

Many disadvantages still need to be overcome regarding omnichannel logistics; even if the availability of affordable drones is increasing, the initial investment remains high, at least for most companies. Not to mention the regular maintenance check cost, repairs, and the training of the workers who do not especially know how to use specific drones.

Even though drones can operate autonomously within direct distribution tasks, it is still essential for workers to understand delivery and logistics protocols to not form supply chain bottlenecks along the way.

A massive boom in technology has happened, and drones are showing strong potential in performance capabilities. This makes it easier for service providers to meet customer expectations while better managing opportunity costs and profits.

The indoor drones which are being analyzed and studied for full implementation will be another essential step for automated supply chains as they will be able to bring many positive effects, such as a fast return on investment. However, innovation is still essential as changes will need to be made for them to be fully operational.

Improve Delivery and Logistics With Help From ModusLink

Despite the necessary adjustments, the rapid growth and advancements in innovative drone technology illustrate a bright future. Would you like to know more about omnichannel logistics, drones, and how to integrate modern tech within your supply chain? Contact one of ModusLink’s Industry experts today to get started with improved delivery and logistics!

Bibliography:

Ashcroft, Sean (2022, February 02) Drone use in supply chain about to take off, Accessed October 16, 2022 From https://supplychaindigital.com/logistics/drone-use-in-supply-chain-about-to-take-off

Baker, P. &. (2007). An exploration of warehouse automation implementations: cost, service and flexibility issues. Academic paper.

Banker. (2019, March 11). The Autonomous Mobile Robot Market Is Taking Off Like A Rocket Ship. Forbes.

Bonn. (2016, June 06). DHL employs robot as picker’s best companion. Retrieved from DHL.com.

Bowles. (2020, November 18). Warehouse robotics: everything you need to know in 2019. Retrieved from Logiwa.com.

Bridger. (2015, October 8). Upgraded cold storage AS/RS boosts Americold’s productivity, labor efficiency. Retrieved from refrigeratedfrozenfood.com.

Croxton. (2003). The Order Fulfillment Process. The Ohio State University. The international journal of logistics.

Dronevideos.com. (2018, September 4). Companies Using Drones In Their Warehouses For Inventory Control & More. Retrieved from Dronevideos.com.

Jules. (2020, April 8). warehouse automation 101: a complete guide. Retrieved from easyship.com.

Koster, A. &. (2017). Robotized Warehouse Systems: Developments and Research Opportunities. Research paper, Rotterdam School of Management, Erasmus University, The Netherlands, School of management, Rotterdam.

Maghazei, W. &. (2019). Applications of drones in warehouse operations. Academic paper, Swiss Federal Institute of Technology Zurich, Chair of Production and Operations Management Department of Management, Technology and Economics, Zurich.

MMH. (2018, March 23). FedEx partners with Vecna Robotics as part of automation growth strategy. Retrieved from mmh.com.

Monroy. (2020, August 28). What is warehouse robotics . Retrieved from 6river.com. Richelle. (2021, January 11). Smart packaging. (Boulanger, Interviewer)

Romaine. (2020, September 15). Pros and cons of AS/RS for warehouse automation. Retrievedfrom conveyco.com.

UPS. (2020, April 23). UPS Pressroom . Retrieved from pressroom.ups.com. Wilson. (2020, February 6). The future of logistics warehouses . Retrieved fromsupplychaindigital.com.

-

COVID 19 The State Of Supply Chains (Part 2)

The shutdowns and disruptions from COVID-19 outbreaks have forever changed the way consumers, retailers, and suppliers work and operate. And the problems created are still being dealt with throughout the supply chain. Companies must accelerate global strategies to customer service and inventory planning processes and management.

It is crucial to understand the problems faced within the global supply chain when it comes to being able to meet customer expectations, contract supply issues, and demand concerns. E-commerce challenges continue to pose a problem as ongoing growth and recovery efforts continue. And those problems will only continue. According to the United Nations Conference on Trade and Development (UNCTAD), COVID-19 pushed e-commerce to $27.6 trillion by early 2021.

Transportation companies must understand why these problems had a significant impact on supply chains across many different companies. It is only when issues and their origin are understood in detail, effective and adequate solutions can be implemented to prevent the return of future negative effects within global commerce.

Now that the negative effects are known and understood to a degree, companies are starting to implement countermeasures. The leading issue supply chains across companies have issues with coping with the impact of the pandemic lies at the current/prior resilience level.

Companies that wish to accelerate global demand planning and supply chain operations need to focus on known issues and improve end to end resilience.

The first part of this article described the negative effects on Supply Chains as a result of COVID-19. It is crucial to understand the problems faced and the reasoning as to why these problems had a big impact amongst Supply Chains across many different companies. It is only when problems and their origin are understood in detail, effective and adequate solutions can be implemented to prevent the return of future negative effects.

Now that the negative effects are known and understood to a degree, companies are starting to implement counter measures. Of course, the type of measure implemented depends on the specific company in question. However, the main issue Supply Chains across companies have issues with coping with the effects of the pandemic lies at the current/prior resilience level. Supply Chains simply did not invest sufficiently in the resilience element to minimize these negative effects. Now, how can companies specifically improve their Supply Chain Resilience?

How Can Companies Improve Their Supply Chain Resilience?

The pandemic will not disappear anytime soon. To improve resilience, companies require steady, start-to-finish appraisal and enhancement, and observation. Robust global commerce analytical systems must monitor constant changes in the marketplace to ensure optimal order processing by a fulfillment partner.

Strong analytical capacity will allow companies to understand the complexity of contract supply better, anticipate potential disruption, and quickly develop a response (BizClik Media, 2020).

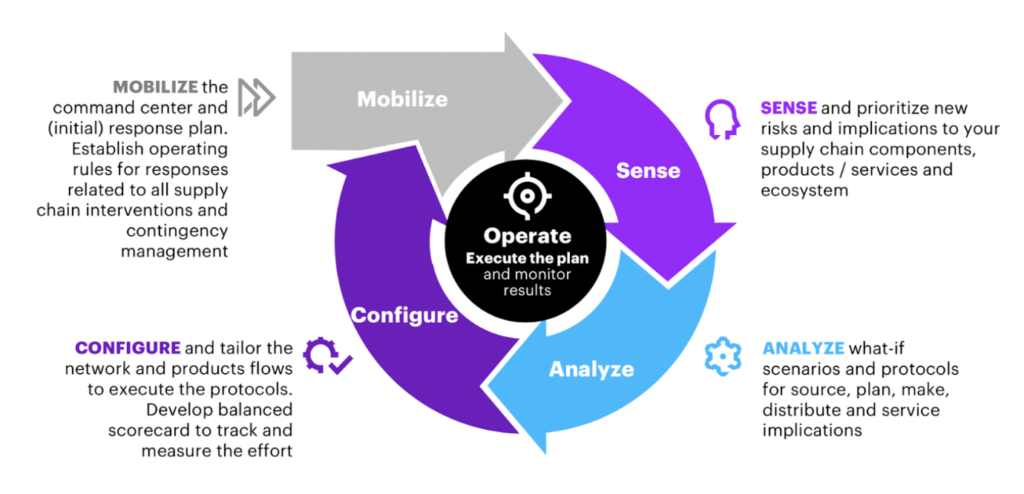

See the figure below for a clear visual on how to improve supply chain planning and supply chain processes in a structured way.

Figure 1 Operate – Execute – Monitor Cycle (Resilience) https://supplychaindigital.com/supply-chain-2/accenture-building-supply-chain-resilience-amidst-covid-19

Steps to Accelerate Global Supply Chain Performance

Let’s create a scenario on how to improve the Supply Chain’s resilience using the diagram above. Remember, the end goal of increased Resilience is necessary to enable and increase a company’s ability to respond accordingly to unexpected changes within the demand/marketplace.

Supply chain management is all about looking for ways to improve key performance metrics. The following steps can help in short term and long term goals.

Step 1: Mobilize

To counter unexpected changes in demand, an initial response plan must be in place that holds specific operating rules. For instance, if demand rises above level X%, automatic notifications must be sent to suppliers A/B to deliver new products on time.

These resilience supply parameters can be established based on safety/stock margins resulting from product priority and lead times to accelerate global metrics. Regular flow and depreciation value also play essential roles in determining these specific parameters.

Step 2: Sense

After creating the fundamental counterplan, risks and implications on the Supply Chain must be identified and analyzed as soon as possible. For instance, if Supplier A uses a specific raw material to create a product known to become scarce upon demand increase, inform yourself about alternatives that enable product delivery past these scarcity levels.

Diversify risks by looking for ways to counter transportation costs and concerns in global commerce, production, and delivery. This is critical for domestic, global, and cross-border processes.

Step 3: Analyze

It is essential to analyze ‘what-if’ scenarios in case of unexpected plan failures. It is best to review these plans and procedures every couple of months, depending on the company, to ensure their validity.

Furthermore, having multiple perceptions on/off the scenarios and solutions may contribute to increased quality and resilience. The more a company asks itself what if x will happen, especially when analyzing contract supply metrics for inventory levels and product designs, the better the understanding of the possible unexpected obstructions.

Step 4: Configure

This final step of this never-ending cycle should include the configuration of the entire counter process. All steps/elements needed to facilitate the counterplan should be in place. New transport/backup modalities, alternate materials, backup machinery, etc.

The more extensive the preparation, the better. This last step ties in with the third analysis step, as the potential disruptive scenarios accelerate global configuration needs.

Improve Global Commerce Performance With ModusLink

After continuous focus on Supply Chain optimization to minimize costs and improve efficiency across the board, COVID-19 clearly illustrates that many companies are not fully aware of the vulnerability of their supply chain relationships to unexpected Global changes within the marketplace/demand (Deloitte, 2021).

Fortunately, new digitalized Supply Chain technologies are showing potential to drastically improve the visibility across the end-to-end supply chain. It is clear that the current linear model of Supply Chains was not sufficient to be resistant to such global changes as the pandemic. Technologies such as the Internet of Things, artificial intelligence, AVG (Automated Guided Vehicles) are designed to anticipate and meet future challenges.

Would you like to know more about the state of Supply Chains moving forward? Stay tuned for our next Blog where we will go more in-depth or talk to a ModusLink Expert today by clicking here!.

Bibliography:

(2021, May 3). Global e-commerce jumps to $26.7 trillion, COVID-19 boosts online sales, Accessed October 20, 2022 From https://unctad.org/news/global-e-commerce-jumps-267-trillion-covid-19-boosts-online-sales

BizClik Media. (2020, May 17). Accenture: building supply chain resilience amidst COVID-19. Supply Chain Digital. Retrieved November 27, 2021, from https://supplychaindigital.com/supply-chain-2/accenture-building-supply-chain-resilience-amidst-covid-19

COVID-19: Managing supply chain risk and disruption. (2021, October 5). Deloitte. Retrieved November 26, 2021, from https://www2.deloitte.com/global/en/pages/risk/cyber-strategic-risk/articles/covid-19-managing-supply-chain-risk-and-disruption.html

G. (n.d.). What impact has COVID-19 had on supply chains & responsible sourcing? Greenstone. Retrieved November 26, 2021, from https://www.greenstoneplus.com/blog/what-impact-has-covid-19-had-on-supply-chains-responsible-sourcing

Gilkey, J. G. (2021, May 1). The challenges and realities of retailing in a COVID-19 world. Researchgate. Retrieved November 28, 2021, from https://www.researchgate.net/publication/351656064_The_challenges_and_realities_of_retailing_in_a_COVID-19_world_Identifying_trending_and_Vital_During_Crisis_keywords_during_Covid-19_using_Machine_Learning_Austria_as_a_case_study

Harapko, S. H. (2021, February 18). supply-chain. Ey.Com. Retrieved November 26, 2021, from https://www.ey.com/en_gl/supply-chain/how-covid-19-impacted-supply-chains-and-what-comes-next

Meyer, A. (n.d.). The Impact of the Coronavirus Pandemic on Supply Chains and Their Sustainability: A Text Mining Approach. Frontiers. Retrieved November 26, 2021, from https://www.frontiersin.org/articles/10.3389/frsus.2021.631182/full

Netherlands, S. (2021, July 27). COVID-19 impact on supply chains. Statistics Netherlands. Retrieved November 25, 2021, from https://www.cbs.nl/en-gb/dossier/coronavirus-crisis-cbs-figures/covid-19-impact-on-supply-chains

-

Inventory Management & Supply Chain Responsiveness

nventory management has always played a key part in any successful supply chain process. Managing inventory levels helps companies to swiftly adapt to unpredictable changes within the marketplace. Volatile demand can cause troubling issues when not handled correctly. That undermines supply chain performance and customer relationship management. When there are weaknesses in how managers link warehouse operations and manage supply chain innovation, the risk increases. In fact, 56% of business leaders still report inefficient inventory management capabilities, asserts Forbes. Let’s take a closer look at how your company can improve inventory management to boost customer experiences, purchase orders, and small business efficiencies.

The Importance of Inventory Management in Public Warehouse Operations

Digitization and automation are at the heart of ongoing growth and recovery and can help businesses overcome common warehousing and inventory issues. For instance, let’s say you are a company that sells seasonal jackets. Due to an unusually warm winter, your winter jackets no longer sell as expected.

Without adapting to the current demand, your winter jackets will become excess inventory over time. Using up public warehouse space to sort, organize, and store excess inventory can get costly.

These negative effects could have been prevented with an adaptive and responsive supply chain across all industries. Knowing how to link warehouse centers, supply lines, and shipping lanes efficiently can improve management and logistics for supply chains.

For example, retail and spa warehouse needs may vary greatly, but they all must still rely on data to track operational efficiency. It is crucial for all businesses looking to scale, to understand the importance of having the ability to shift production toward demand.

Steps to Take for Better Supply Chain Responsiveness And to Link Warehouse Operations

Correctly managing inventory levels and knowing how to effectively link warehouses requires a responsive supply chain, but what exactly does that mean?

According to IGI Global(n.d.), a strong supply network can be defined as a supply chain that is able to shift its production to unpredictable customer demand. How do supply chains do this?

One way to realize a responsive network is to correctly manage logistics warehouse and inventory levels..

Boost Inventory Management

Correctly managing Inventory levels can be a struggle, depending on the marketplace and products in question. See below the best ways you can effectively improve your inventory management by making your logistics warehouse processes more responsive.

Working with the best fulfillment partner can ensure inventory management remains front and center at all times. It allows companies to better regulate inventory and keep up with critical supply chain processes. This focus makes optimization and responsiveness much easier.

Improve Supplier relationships

Products that require multiple raw materials or parts from different suppliers are heavily reliant on active supplier relationships. Companies that trade in those products ought to continuously look for ways to improve their supplier relationships, including public warehouse access and utilization.

Having a better understanding of your supplier’s business position (and vice versa) allows a company to better anticipate and forecast possible disruptions and improve the way they coordinate and link warehouses and other applicable chain parties. This maximizes the throughput speed at which new materials can be ordered and received, in turn increasing your adaptability to the marketplace. Having access to the best supply chain tools can also help significantly. .

Figure 1(Supplier Relationship Management) Significance of Healthy Supplier Relationship. (n.d.). from https://www.strategicsourcing.pk/2015/12/significance-of-healthy-supplier.html

Enhance Risk Management

Another way to improve inventory control and build supply chain responsiveness is through effective risk management. Especially in turbulent times and strong unforeseen events such as COVID-19, the element of risk management is crucial for any business looking for ways to boost logistics warehouse operations and streamline operations.

Especially for SMEs (Small-Medium-Enterprises) looking to invest in new technology, a detailed risk analogy of the sought-after investment must always be made prior to continuing business. Automation and digitalization are important elements in linked warehouses nowadays. Despite the importance of these elements, never invest without proper risk-return analysis.

Consider Outsourcing Options

A method to the improvement of performance and inventory management that has become increasingly popular over the years is the concept of outsourcing. Companies such as ModusLink are industry experts with years of industry experience and knowledge regarding public warehouse and inventory management processes.

Companies that rely on warehouse and distribution services need sound logistics warehouse management processes. Without a solid foundation, the entire network will struggle from the start. For many companies, the easiest solution to this shortcoming is to outsource services.

Looking Forward to Future Growth and Success

Some companies today can also be price-competitive, increasing the attractiveness of outsourcing your supply chain. These companies use their extensive network, supplier relationships, and vast IT infrastructure to massively increase supply chain responsiveness and inventory management processes. They understand the importance of linked warehouse operations.

Companies that outsource effectively gain the ability to spend resources elsewhere. This allows their business to flourish in a short-time period and more importantly, increases their ability to scale effectively. The effects of COVID-19 have forever changed the market and how consumers shop, which has forever altered how inventory management and supply chain responsiveness is measured.

Improve Logistics Warehouse Operations With ModusLink

These three elements are important ways to Increase a supply chain’s responsiveness and in turn, increase inventory management. There are plenty of other ways a business can improve its supply chain strategy and boost the ability to link warehouses effectively.

Would you like to know more about these innovative strategies and how to improve supply chain operations with enhanced inventory management? Contact ModusLink today to learn more and to see how easy inventory management can be when you have the right tools and guidance!

Bibliography:

Amsler, S., O’Donnell, J., & Cole, B. (2021, February 11). inventory management. SearchERP. Retrieved November 24, 2021, from https://searcherp.techtarget.com/definition/inventory-management

Significance of Healthy Supplier Relationship. (n.d.). Strategic Sourcing. Retrieved December 3, 2021, from https://www.strategicsourcing.pk/2015/12/significance-of-healthy-supplier.html

Walts, A. (2021, October 29). Your Essential Guide to Effective Inventory Management + 18 Techniques You Need to Know. The BigCommerce Blog. Retrieved November 21, 2021, from https://www.bigcommerce.com/blog/inventory-management/

What is Responsive Supply Chain | IGI Global. (n.d.). IGI. Retrieved December 3, 2021, from https://www.igi-global.com/dictionary/building-a-strategic-framework-for-retail-supply-chain-analytics/52748

-

What is Smart Packaging.

The importance of correct packaging

Each product shipped along domestic and international supply chain lines has its natural flow from beginning to end. Packaging is an essential element that manifests its presence within all stages of the product flow. Improving the whole supply chain from end to end relies on improved logistics and direct distribution processes.

These stages can be identified as the purchase of raw materials, the production and sale of the final product, and not to forget transportation, packaging, and distribution resources. Global ecommerce and online shipping services have become more influential than ever before. This critical piece of the supply chain cannot be ignored.

Packaging logistics is quite a new discipline that has gained consideration in terms of its strategic aspect in providing a significant competitive advantage to improve the efficiency of the direct distribution and internal supply chain logistics and shipping process.

Over the years, packaging has become a significant challenge for companies. Companies must analyze and study the best way to pack products taking into consideration many vital factors.

The characteristics of the products, such as the shape, components, etc., must be taken into account to minimize cost and improve the companies’ performance and reliability. As a result, the emphasis on packaging systems has grown substantially recently (Regattieri, 2013). This is true for traditional distribution and shipping as well as cross-border e-commerce solutions.

Whether a company specializes in local retail shipping and distribution, a solely online shot front, a hybrid blend of online and brick and mortar, or is looking at selling internationally on Shopify and similar Shopify markets, or a similar online platform, it all comes down to making smart choices at this critical point.

The Importance of Correct Packaging and Distribution Resources

Traditional packaging and distribution methods are insufficient to meet shifting market needs and changing consumer expectations. Working with local distribution providers as well as international domains and providers makes packaging all the more essential.

Understanding the different types of smart packaging available can set struggling companies apart from successful ones. Digital businesses, brick-and-mortar shops, online stores, and M-commerce solutions all benefit from this innovation.

Smart packaging consists of packaging systems with embedded sensor technology used for different product tracking. Direct distribution aims to extend its shelf life, track and trace products, monitor freshness, display information on quality, or improve the effect on customer safety.

Smart packaging contributes to the overall supply chain efficiency by constantly contacting the products through strategic sensors devices on the packaging. Smart packaging is integrated into products such as food, pharmaceutical, and many more. The Supply Chain packaging and distribution resource management are currently in a growth phase with immense potential.

New innovations with digitalization and automation, such as thin-film electronic and antimicrobial packing, are being analyzed to increase their capabilities and become even more accurate and safer (Cheung, 2018). It all comes down to improving supply chain management processes from end to end.

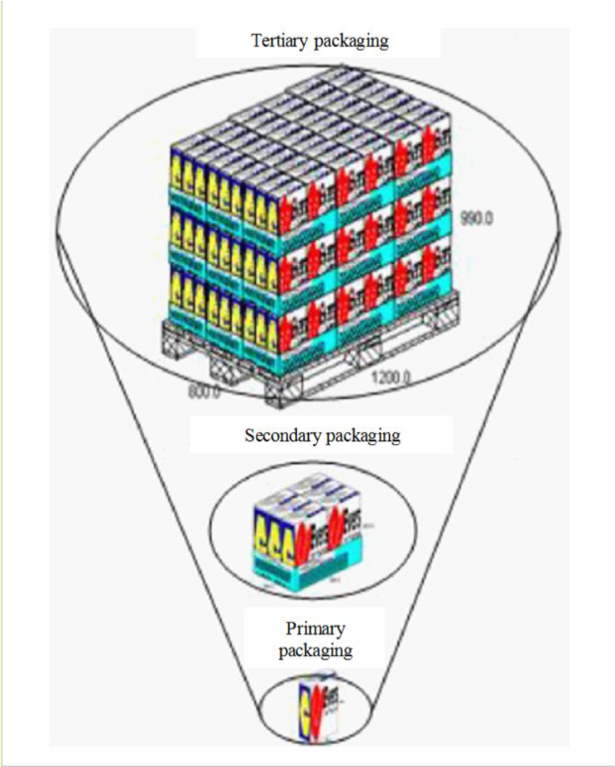

The three main Packaging levels and Direct Distribution

The packaging process consists of three primary levels. The first level is about the structural nature of the package. This phase is the smallest. Within this phase, the package is in direct contact with the actual content.

The second level deals with visual communication and customer satisfaction. The primary purpose of the second level is to keep packages in que and to follow their progress. It is a critical piece of the direct distribution puzzle.

Finally, the third level is designed and used for transportation and storage, such as cartons. The packaging system is cross-functional, which means that different departments dealing with the system each have specific requests about the design of the package.

The three package levels involved in packaging and distribution resource management are illustrated in the schema below.

The three package levels are illustrated in the schema below.

(Regattieri, 2013).

Smart Packaging Improves Security and Delivery Success

The security of the products can be monitored by research design to increase the safety of the product during manufacturing and assembly, storage and picking, and transport. Smart packaging also plays an important role in traditional packaging. Information transmission is used to inform the management team on the correct way to store or transport the contained product. Organizations also integrate the internet of things (IoT) through an electronic device RFDI (radio-frequency identification) which is a tag on packages to enable companies to identify the products in real-time, reducing the risk of damages and mapping the path of the products to control the work in progress. An unprotected product could cause product waste which can be negative from an environmental and economic point of view (Regattieri, 2013).

Shipper and Carrier Benefits to Smart Packaging

Smart Packaging can offer various advantages. They can fulfill the information, automation, marketing, and protective functions.

To accomplish this, packages are equipped with tiny electronic devices that add functionalities such as barcodes, LED, augmented reality, NFC (near field communication), loudspeakers, and displays.

A good example would be intelligent drug packaging with built-in RFID (radio frequency identification) chips that can track and report the location and status of each individual box, pallet, or load. It helps all involved parties better manage packaging and distribution resources.

Smart Packaging has a strong customer empowerment element through great new technological tools. These supply chain tools can offer a customer interface that is used to understand the different purchased products better.

Quality control is another strong advantage of direct distribution and packaging and distribution resource monitoring. Active packages use sensors that are being placed on the product. Organizations can detect the product’s status and see whether it is good or compromised.

Furthermore, advanced packages can even go further by extracting unwanted particles inside the package which can increase the shelf life. These sensors result in easy access to the manufacturer’s final quality products and longer-lasting solutions (impacx, 2020).

Innovative packaging has made the process of locating products much easier and safer, as too many products are difficult to track within a complex supply chain (Choudhury, 2018). It is easy to improve the shopping experience and improve customer services with smart packaging solutions like these.

Make the Most of Packaging and Direct Distribution with ModusLink

The many advantages mentioned above attract companies to switch from traditional packaging to Smart Packaging. It comes down to better packaging and distribution resource management and shifting from manual outdated processes and shifting to processes with advanced technologies. It all comes down to making smart choices with packaging and distribution that make the logistic operation more resilient.

Would you like to know more about the best way to integrate Smart Packaging within your current direct distribution processes and supply lines? Contact one of ModusLink’s industry experts today to get started.

Bibliography:

Aliakbarian. (2019, February 20). Smart packaging: challenges and opportunities in the supply chain. Retrieved from supplychainquaterly.com.

Bianchi. (2017, June 28). 5 Examples of Innovative Uses for RFID Technology in Retail. Retrieved from shopify.com.

BioSpectrum. (2012, July 16). Packing smart for better reach of vaccines. BioSpectrum digital edition. Retrieved from https://www.biospectrumasia.com/.

Cheung, S. &. (2018). Smart Packaging: Opportunities and Challenges. University of Liverpool & University of Northumbria, Department of Mechanical and Construction Engineering & Division of Industrial Design. Liverpool: Elsevier.

Choudhury. (2018, April 05). Top Benefits of Smart Packaging for Packaging Companies | Infiniti Research. Retrieved from Infinity research.

Emprechtinger. (2019, April 18). 5 things you should know about smart packaging. Retrieved from lead-innovation.com.

Fedex. (2020). Tracking Technologies Are the Cornerstone for a Competitive Supply Chain Strategy. Retrieved from Fedex.com.

FreightPOP. (2019, September 3). Barcodes, QR Codes, & RFID In Supply Chain Management. Retrieved from freightpop.com.

Hou, L. &. (2016). The Application of NFC Verification System in Warehouse Management System. South China University of Technology, School of Computer Science and Engineering. Guangzhou,: Atlantis Press .

impacx. (2020). What is smart packaging and its benefits? Retrieved from impacx.io. Jules. (2020, April 8). warehouse automation 101: a complete guide. Retrieved from

easyship.com.

Pagliusi, J. &. (2020). Roadmap for strengthening the vaccine supply chain in emergingcountries: Manufacturers’ perspectives. Elsevier.

Regattieri, S. &. (2013). The Important Role of Packaging in Operations Management. InOperations management .

Richelle. (2021, January 11). Smart packaging. (Boulanger, Interviewer) Thrams. (2020, November 25). Big Benefits of Smart Packaging . Retrieved from

primarypackaging.com.

Vasić, Đ. &. (2018). NFC Technology and Augmented Reality in Smart Packaging. University ofNovi Sad, Faculty of Technical Sciences., Department of Graphic Engineering and

Design. International Circular of Graphic Education and Research.

Ward, h. &. (2019). Rethinking packaging. DHL , Supply chain department. DHL CustomerSolutions & Innovation Represented by Matthias Heutger.

WHO. (2020). Bar-codes, QR codes and Vaccine Vial Monitors in the context of COVID-19 vaccines. World Health Organization. -

The introduction of E-Procurement.

The introduction of E-Procurement:

Price and availability are not the only factors to be considered in a purchasing decision, especially now that a robust supply chain has become an unmissable element for every company in today’s business climate. The supply chain sector is always changing and adapting and business owners must be able to keep up and adapt as needed. Improved digitization and automation within e-business and e-commerce is a leading option.

Managing the complex web of advantage logistics and supply chain operations is both complicated and streamlined by e-commerce trends. It is important that those doing business online understand the connection and relationship these two sides of the same coin share.

The dynamic of business worldwide is changing rapidly due to fast-growing technological advancements. The ease of accessibility of this technology causes many organizations to shift towards E-Procurement as an effective and strong supply chain support system.

Innovative processes and systems like this can help companies reach operational efficiencies, sustainability, and profitability goals. All online businesses must keep a sharp eye on logistics and purchasing trends. This is true whether a business is looking for where to get products to sell on Shopify or any other finer details involved with e-commerce management.

Using E-Procurement for Advantage Logistics Management

The use of E-Procurement has recently increased as technologies positively affect different sectors worldwide. E-procurement, known as ‘electronic procurement’ or ‘supplier exchange’, is changing how companies are sourcing their goods and services.

Advantage logistics and an omnichannel supply chain help managers and business owners improve procurement online and simplified business processes. According to (Namulo, 2017), “E-Procurement is the acquisition of goods, services or works from an external source. In procurement, it is necessary to ensure that the goods, services, or works are appropriate and that they are procured at the best possible cost to meet the purchaser’s needs in terms of quality, quantity, time, and location.”

Over the last ten years, institutions have used more electronic tools to manage their procurement activities. Organizations in both public and private sectors are adopting systems such as the Electronic Data Interchange tool (EDI), Enterprise Resource Planning (ERP), and of course, the internet to benefit them when sourcing their goods (Adebayo, Dec 2015).

Advantages/Disadvantages of E-Procurement

E-procurement is a tool that yields benefits in all kinds of ways. It enables companies to decentralize operational processes and centralize strategic procurement processes. This approach to advantage logistics results in higher transparency and integrity, as well as reducing transaction cost and boosting decision-making processes.

E-procurement enables price negotiation and supplier evaluation. It also allows selection to be automated between organizations and their suppliers, which prevents time consumption. It helps reduce human errors, increase operational speed and enable staff to focus on other tasks.

Moreover, e-procurement enables companies to have a good workflow that facilitates end-users self-services. The inflows/outflows of goods through the supply chain improves as the tracing and tracking of those goods are automated, reducing emergency shipments.

Institutions can visualize their purchasing behaviors to control purchasing management and save costs by identifying leverage buying power (digital, n.d.). Being connected to external supply chains and enterprise resource planning (ERP) enables companies to get a better overview of supplier transactions and information by sharing real-time data through ERP systems, improving communication (digital, n.d.).

It is important to note that there are also obstructing factors that prevent implementing effective procurement for some e-commerce businesses. Lack of strong business relationships, financial support, and organizational priorities can also form obstacles. Developing countries are usually late adopters and do not invest money into early adopters’ trends and often struggle with advantage logistics and more complex supply chain and online business logistics within the global supply chain

Concept of Implementing E-procurement in Online Stores and Businesses

Electronic procurement innovations (EPIs) are being utilized by many businesses to improve their supply chain and advantage logistic processes. EPIs support the different parts of businesses’ core procurement process, such as supplier selection, order placement, order fulfillment, supply chain tools usage, payment settlement and ecommerce fraud protection.

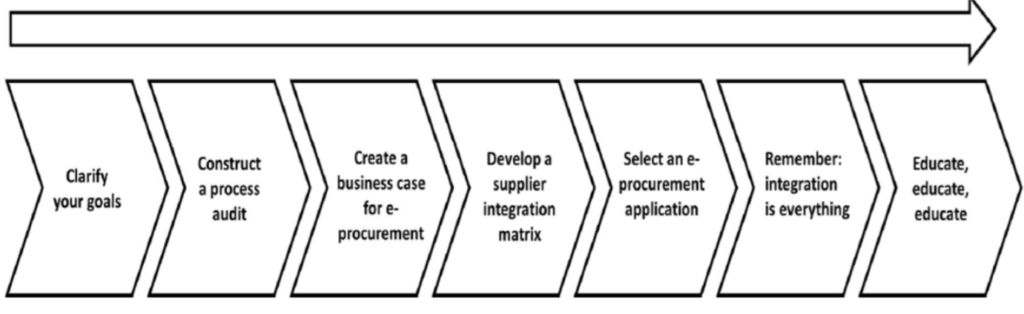

Many organizations use the scheme below to help implement e-procurement into their supply chain (Namulo, 2017). Successful implementation of e-procurement depends on strong good management to achieve the firm’s performance goals and to maintain high levels of customer service. This makes it easier to target audience groups and use internet technology to sell products and services more efficiently.

It is essential to be aware of what adopting e-procurement means on a long-term and short-term basis. E-procurement has become a powerful tool resulting in a competitive advantage for many businesses. It is integrated into many firms’ overall strategies as the role of IT has evolved from productivity to a strategic tool (KANDA, 2017).

(Namulo, 2017).

Five Forms of E-Procurement to Know:

Understanding the inner workings of e-commerce, e-procurement, and e-business operations can help owners and managers in the short and long term. E-commerce fraud protection and other vital processes are easier when team members know what to expect along the way.

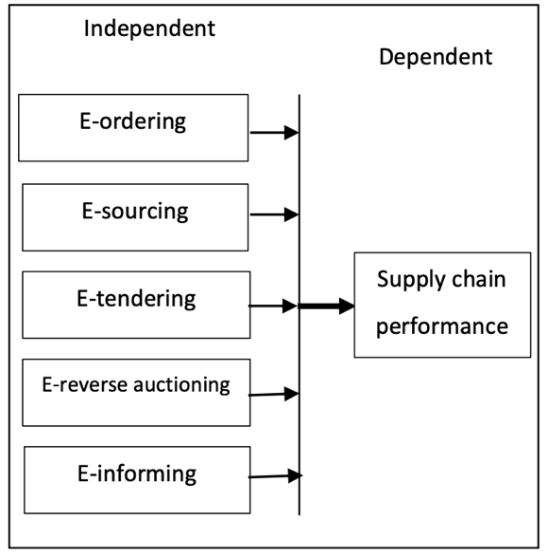

Supply and demand cycles and consumer buying habits have been altered by the COVID-19 pandemic and businesses must shift focus to compensate. An electronic procurement system can be categorized into five main applications within advantage logistics, which consist of E-ordering, E-sourcing, E-tendering, E-auctioning, and E-informing.

- E-ordering: is a popular option. Based on (Zaman, 2019), E-ordering captures electronic data, including orders, requests, and information received by the customer. From the supplier’s side, E-ordering can reduce errors and eliminate papers as invoices are automatically generated from the order information through the internet (Edicom, 2020).

- E-sourcing is described as selecting and identifying suppliers based on specific requirements. This approach allows the firms to choose their preferred suppliers considering their competitive aspects.

- E-tendering is when the suppliers receive the invoices and the purchase requests. This process allows both suppliers and buyers to realize their online transactions. Moreover, the procedure covers the tender requirements, which will be exchanged electronically through the CRM platforms (Zaman, 2019).

- E-auctioning: Online reverse Auctions facilitate the buyer’s ability to select suitable suppliers to buy products or services. Instead of negotiating with several suppliers before choosing one, this process helps with reducing the cost of contact and providing feedback and privacy (Namulo, 2017).

- E-informing: This method includes assembling and gathering information regarding purchases of buyers and suppliers by using web-based technology (Zaman, 2019). It leverages the power of digital platforms and data-sharing systems to strengthen businesses.

The supply chain performance is dependent on each of the stated independent e-procurement steps. These steps aim to improve the overall supply chain performance. (Zaman, 2019).

Master E-Procurement Processes Today With Help From Industry Leaders

The supply chain performance is dependent on each of the stated independent e-procurement steps. These steps aim to improve the overall supply chain performance. Would you like to know more about adopting E-Procurement within your supply chain? Contact one of ModusLink’s Industry experts today to get started with advantage logistics.

Bibliography:

Adebayo, V. &. (Dec 2015). Adoption of e-Procurement Systems in Developing Countries: A Nigerian Public Sector Perspective. In V. &. Adebayo, 2015 2nd International Conference on Knowledge-Based Engineering and Innovation (KBEI) (Vols. pp. 20-25, pp. 20-25). Tehran, Iran: IEEE.

Cheney, C. (2020, July 01). How COVID-19 has advanced the case for procurement reform. Retrieved from Devex.com. demery, P. (n.d.). Digital commerce 360 . Retrieved from digitalcommerce360.com.

digital, W. (n.d.). What is e-procurement . Retrieved from Waxdigital.com.

Edicom. (2020, March 12). What Are Electronic Orders? Benefits and Success Cases in Europe.Retrieved March 2020, from Edicomgroup.com.

KANDA, V. I. (2017, April). Factors Affecting the Adoption of e-Procurement Systems among

International Non-Governmental Organisations in Kenya. International Journal of Academic Research in Accounting, Finance and Management Sciences, 7(2), 164-176.

Kapepo, S. K. (2019, July ). The Role of Institutional Pressures in the Adoption of e-Procurement

in Public Institutions in Developing Countries: The Case of Lesotho. The African journal of information systems, 11(3 ), 232-248.

Mwangi, E. W. (2016, August 19). EFFECTS OF E-PROCUREMENT ON PROCUREMENT

PERFORMANCE IN HOSPITALITY INDUSTRY IN KENYA: CASE OF SAROVA CHAIN OF HOTELS. International Academic Journal of Procurement and Supply Chain Management, 2(2), 1-19.

Namulo, M. M. (2017, August). Employee Adoption of E-Procurement and its Implication on Supply Chain in Developing Countries. International Journal of Computer Applications , 171(9), 11-15.

NGUI, A. M. (October 2016). BARRIERS TO E-PROCUREMENT ADOPTION BY SMALL AND MEDIUM ENTERPRISES IN MACHAKOS COUNTY. reserach paper, UNIVERSITY OF NAIROBI, SCHOOL OF COMPUTING AND INFORMATICS, Nairobi.

Oracle. (n.d.). What is ERP . Retrieved from Oracle.com – Malaysian Manufacturing Firm. International journal of supply chain management, 8(2), 923-929.

-

Sustainable Supply Chain Management.

Green supply chain history:

The origin of Supply Chain Management and modern supply chain history dates back to the early 20th century with Henry Ford, who vertically integrated the automotive supply chain and organizational practices. The approach of “Just in time” and “supply chain management” focused on optimizing efficiency and reducing waste- including water pollution, noise pollution, air pollution, and more. The impact these waste products have on human health, as well as the environment, is becoming increasingly important for consumers.

Nowadays, many factors are increasing the urgency for emerging economies to become sustainable. The shifting consumer focus and changing market demands mean more and more high paying logistics jobs are available and these niche services are increasingly needed. Digitization and automation go hand in hand with increased productivity and sustainability today.

A great example would be climate change and how that has affected the overall shift in supply chain operations from improved fuel conservation to stronger 3PL partnerships and the increasing popularity of google warehouse and third-party options. The struggle to contend with environmental pollution concerns is becoming more vital than ever before among businesses of all sizes and across all industries and markets.

Why Go Green- What 3PL Reports Show

Due to climate change, firms are rethinking their strategies to guarantee environmental initiatives to start ecological actions. Furthermore, the notion of Sustainable Supply Chain Management is often linked with social responsibility or environmental management (Ali Esfahbodi, 2016).

Green Supply Chain Management (GSCM) emerged as a new environmental approach in logistics and has been increasingly used by forward-thinking organizations. Many companies today are looking for ways to save time and money, which is why services such as google warehouse operations and other 3PL relationships are becoming more popular than ever.

Different reasons to turn to GSCM include strong benefits of sustainable, profitable, and cost reducing operations. Customers usually say that they would instead buy products that are environmentally friendly and with a minimum of environmental impact.

Business practices ought to become increasingly transparent; therefore, the green policy can generate profits, provide a positive social impact, and reduce environmental impacts. Shifting away from fossil fuels to more sustainable options is a key part of modern supply chain engineering and logistical management.

Any steps taken to become greener within e-commerce solutions will favor companies in visibility, and credibility, and develop a leadership reputation (Bhattacharjee, 2015). Implementing more sustainable practices, shifting to greener modes of transport, and improving fuel consumption and truck routing processes can have a significant impact on the supply chain today.

Sustainable Supply Chains and Google Warehouse Management

The original model of Supply Chain Management follows a linear production that hypothesizes the constant input of natural resources and an unlimited capacity to assimilate waste. Unlike the traditional supply chain, being sustainable considers the environmental impact of a product through its entire process cycle and reduces maximum environmental damages.

The idea of being sustainable is done by closing the loop and including the reduction, reuse, and recycling processes. This will alter the environmental impact of e-commerce lines from acquiring raw materials to the final use and disposal of the product (Ali Esfahbodi, 2016).

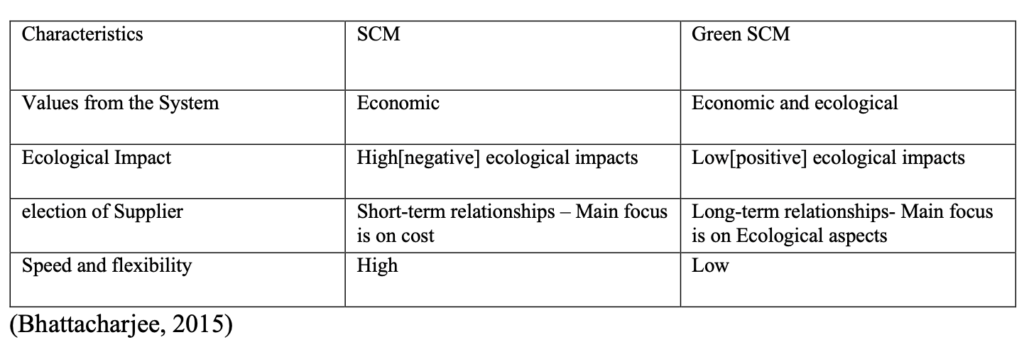

The purpose of going green is shown in the table.

Sustainable supply chain management:

The original model of Supply Chain Management follows a linear production that hypothesizes the constant input of natural resources and an unlimited capacity to assimilate waste. Unlike the traditional supply chain, being sustainable considers the environmental impact of a product through its entire process cycle and reduces maximum environmental damages. The idea of being sustainable is done by closing the loop and including the reuse, recycle step. This will aim at reducing environmental impact from the acquisition of raw materials to the final use and disposal of the product (Ali Esfahbodi, 2016).

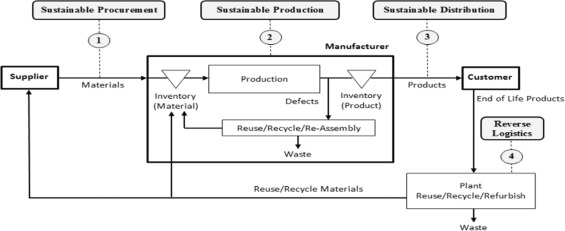

Based on (Ali Esfahbodi, 2016), the main activities in a typical sustainable supply chain management (SSCM) are illustrated above. When the product has a defect after its production, it is sent back to the inventory to reuse or recycle it. When the product comes to its end, it goes to the plant where the product is reused, recycled, or refurbish before heading back to the supplier.

Four fundamental practices:

Understanding the way traditional vs e-business models impact sustainability is a vital step to the optimization of the supply chain. Based on (Ali Esfahbodi, 2016) research, Chinese and Iranian governments have focused their fight for GSCM based on four fundamental practices: sustainable procurement, sustainable production, sustainable distribution, accurate 3PL reporting, and reverse logistics.

These practices represent how each country engages itself toward Sustainable Supply Chain Management. In addition, these initiatives are not just used in China and Iran but also in many other emerging economies. These innovations represent a substantial commitment through strategic environmental plans toward sustainable Supply Chain Management.

Sustainable Procurement

consists of environmentally friendly purchasing that carries reduction, reuse, and recycling options. Furthermore, it is a solution to achieve a selection of products and services that reduce the negative impact of the life cycle.

Sustainable purchases become easier throughout the year with fewer barriers as customers increase their demands for environmentally friendly goods (Vishal Gupta, 2013). Ikea is a good example as it has sourced close to 50 percent of its wood from sustainable foresters and a hundred percent of its cotton from farms that meet better cotton standards (Ikea, n.d.).

Sustainable Production

Is the production process that uses inputs with low environmental impact, is greatly influential, and causes no waste pollution. Green production can improve the corporate image and lower the raw material cost.

Companies are starting to take action and produce materials that intend to be reliable, and energy-efficient with no or lesser waste. This benefits companies in many ways as it will impact customers, shareholders, and the company’s recognition in the e-commerce marketplace. (Vishal Gupta, 2013).

Sustainable Distribution

The distribution of goods usually generates a lot of waste and it can damage the environment, but green distribution consists of green packaging including size, shape, and materials that have an impact on the transportation of the goods.

Better packaging can reduce material usage, increase space utilization in the warehouse and trailer, and lower the quantity of handling required (Vishal Gupta, 2013). Logistrap does it in Mexico, they reduced their space within the warehouses and container ships to transport more within the same number of trips (Logistrap, 2020).

Reverse Logistics

According to (Vishal Gupta, 2013) the concept of Reverse Logistics (RL) means the returns from not only the customers but also the management of E-waste. RL is a process where a manufacturer accepts previously shipped products from the customer’s point of view for potential recycling and/or re-manufacturing.

Partnerships such as google warehouses and 3PL service providers can improve reverse logistics and keep the supply chain flowing smoothly with enhanced supply chain tools and tech. Backward integration and monitoring are necessary, especially during peak seasons when purchases, as well as returns, can be higher than normal.

Improve 3PLS Reports and Logistics Management With ModusLink

Do you need help figuring out how to become more sustainable within your management and logistics operations? Mastering the flow of 3PL reports, google warehouse management, and other supply chain management operations is a vital part of modern business operations today. Contact one of ModusLink’s leading supply chain management and logistics experts.

Bibliography:

12 Million Bottles Used in Patagonia Recycled Clothes. (1995, April 12). Los Angeles Times. Ali Esfahbodi, Y. Z. (2016). International journal of production economics (Vol. 181 part B). (S.Minner, Ed.) Birmingham , UK: Elsevier.

Avittathur, A. A. (2016). Green Retailing: A New Paradigm in Supply Chain Management.

Calcutta, India: IGI Global.

Bhattacharjee, K. (2015). Green Supply Chain Management- Challenges and Opportunities.

Research scholar, Patna University, Applied economics & Commerce, Patna. Cardwell, D. (2014, July 30).

At Patagonia, the bottom line includes the earth. The New York Times(section B), 1.

CHAPPELOW, J. (2016, March 16). Emerging market economy. Retrieved from Investopedia. consulting, T. E. (n.d.). reverse logistics in a circular economy. Retrieved from Triple EFFconsulting.

EM Ojo, C. M. (n.d.). GREEN SUPPLY CHAIN MANAGEMENT IN DEVELOPING COUNTRIES. In C.

M. EM Ojo. Johannesburg, South Africa : Department of Mechanical Engineering Science, University Of Johannesburg, Johannesburg, South Africa. Ikea. (n.d.). Corporate news. Retrieved from Ikea.com.

Kobo360. (n.d.). Kobo. Retrieved from Kobo360.com.Logistrap. (2020). Logistrap packing services. Retrieved from Logistrap.com. 15

Mohsin Malik, S. A. (2019). Sustainability Initiatives in Emerging Economies: A Socio-Cultural Perspective . Swinburne University of Technology. / Abu Dhabi University., Department of Business Technology and Entrepreneurship / College of Business Administration. Abu Dhabi, UAE.: MDPI.

O. Zhu, J. S. (2005). Green supply chain management in china: pressures, practices and performance (Vol. 5).

Queiroz, M. M. (2019). Environmental Quality Management (Vol. 3). (Wiley, Ed.) Wiley.

Rama K. Jayanti, M. R. (2014). Sustainability dilemmas in emergingeconomies. (I. M. review, Ed.)Bangalore, India: Elsevier Ltd.8).

Vishal Gupta, N. A. (2013, January). Green Supply Chain Management Initiatives by IT

Companies in India. The IUP Journal of Operation Management , 12(2), 6-24.

-

The Circular Economy.

The Circular Economy

Taking the fastest route towards your destination is often the most effective one as you will use the least time possible. However, is it also the most efficient? This is a completely different question. Your efficiency depends on how you determine your efficiency factor. Is your idea of efficiency to spend the least amount of money on fuel? To take the route in the most sustainable way possible? To see the most beautiful scenery along the way? If your idea of efficiency is one of these mentioned, your strategy of taking the fastest route is probably not a good idea. This concept of efficiency is crucial for businesses to understand as it allows them to optimize their operational activities and business model.

Businesses often conduct their operations as streamlined as possible with the integration of supply chain tools, omni logistics, e-commerce practices, and sustainable processes. To improve payment processing, customer service, logistics management, and to have a strong supply chain, it will take strong commitment and focus. Let’s take an average supply chain from a start-up.

Supply Chain Processes and the Circular Economy

Understanding the processes used by businesses of all sizes is critical for supply chain operations today. Everything from logistics company names to reputation and internal processes need to be considered.

First, the sought-after raw materials are procured. Then, the business uses these raw materials and labor to convert them into their final product. Lastly, this product is sold, and any waste material is disposed of.

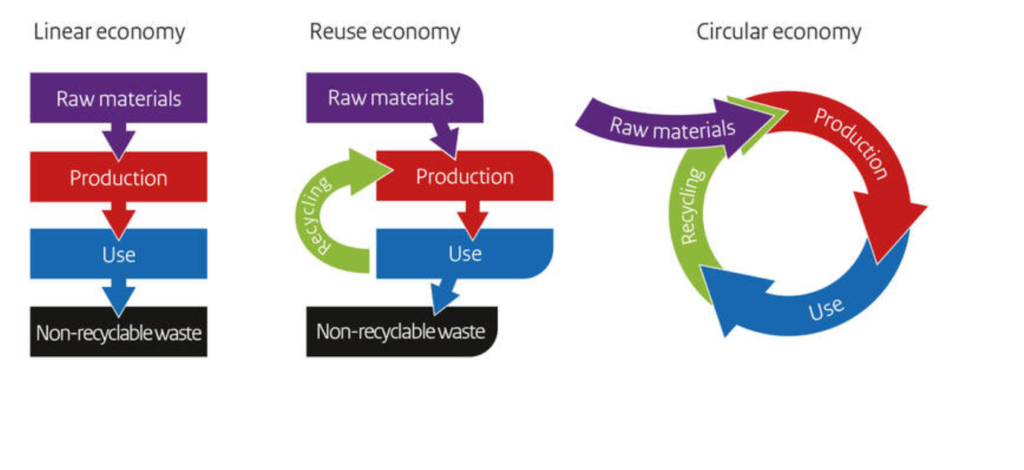

This Linear way of conducting business is often how many start-ups begin their journey as it seems practical and straightforward. Depending on your business model/goals, there might be an alternative way to conduct business that yields benefits such as increased resource utilization, labor force efficiency, and sustainability within your business model.

The circular economy is a term used within Business practices that primarily aims to reinforce sustainability within business elements (Ministerie van Infrastructuur en Waterstaat, 2019). It is a great piece of the subscription management solution and customer subscription management. It is a foundational process.

The fundamental pillars of a circular economy are made of the term reusability. Instead of disposing of waste, waste materials are used through methods such as recycling, aiming to give purpose to waste.

During the end-to-end creation of glass but can be utilized more effectively. This residue is melted in a circular economy to create new glass. It is a circular process that feeds from one into the other and saves time, money, resources, and labor..

Integration of Subscription Management Solutions and Omni Logistics

There are many Supply Chain elements where the Circular Economy concept can be integrated. These elements include the following.

- Product design

Fundamentally altering product design can yield strong sustainability benefits. This is often best done when releasing/starting a new product, as big changes could take time to implement on scale. Sustainable packaging and product labelling is a way to integrate the Circular Supply Chain concept. The razor blade company ‘Boldking’ for instance gives their customers discounts on future products when sending back their packaging. The used packaging is later converted into new razor blade packages.

- Procurement

Raw materials that are technically restorative or intrinsically reusable have a low negative environmental impact thus increasing sustainability within Supply Chains. The concept of acquiring such materials is often called ‘Green Procurement’.

These materials increase the utilization rate and decrease waste generation. Examples are glass and paper as mentioned earlier and there are many other examples of subscription management solutions and sustainable processes that are in high demand today.

- Production

Sustainable manufacturing practices are a great way to maintain a Circular Supply Chain. Although green production hasn’t been widely used (mostly due to cost-benefit compared to cheap labor), it certainly yields strong benefits when implemented correctly.

Producing using renewable energy sources such as Solar Power reinforces an autonomous production process. It is also a key component of omni logistics and supply chain operations.

- Logistics

Sustainably distributing products can be achieved through route optimization and avoiding concepts such as same-day delivery. It is important to be aware of your current logistical process. Consulting experts on the best way to distribute your products or manage your internal logistical process can be extremely beneficial as professional expertise can guide (in)experienced businesses in the right direction.

- Consumption

Consumption is an interesting way to apply Circular Supply Chain Management as it has not been used until recently. It is predominantly gaining traction within the mobile phone industry where unwanted phones are returned to the respective company in return for discounts on newer models. Since new phones are often released on an annual basis, this is a great way for companies to regain their resources.

- Waste Management

Waste management is essentially reusing waste material for your production process. To take the prior example, the unwanted and returned phones (waste) are not disposed of but instead taken apart carefully. Individual elements such as the processing unit, battery, Glass, metal frame, are all given a new purpose by reusing them in the new production process.

- Supply Chain Technology

The newest addition to integrating a Circular Supply Chain into a business is done through Sustainable Technology. This concept hasn’t been adopted on a wide scale as much technology is relatively new, however, some companies see the benefits gained from certain technology.

TTechniques and concepts such as IoT (Internet of Things) and omni logistics can yield substantial benefits when adopted correctly. If there is no inside knowledge on these concepts, it is strongly advised to seek professional expertise.

Bringing Circulate Economy Trends Together With Supply Chain Management

Circular Supply Chain Management (CSCM), integrates the philosophy of the circular economy into supply chain management. This creates a new and compelling perspective on the supply chain sustainability domain (Farooque et al., 2019).

Need professional advice on the right way to integrate circular supply chain management and sustainable subscription management solutions? Contact one of ModusLink’s Industry experts to get started!

Bibliography:

Angelis, D. R. (2018). [PDF] Supply chain management and the circular economy: towards the circular supply chain | Semantic Scholar. Semanticscholar.Org. https://www.semanticscholar.org/paper/Supply-chain-management-and-the-circular-economy%3A-Angelis-Howard/68c441507594095a7f07af8018c844194b88fa84

Farooque, M., Zhang, A., Thurer, M., Qu, T., & Huisingh, D. (2019, April 1). Circular supply chain management: A definition and structured literature review. ResearchGate. https://www.researchgate.net/publication/332690616_Circular_supply_chain_management_A_definition_and_structured_literature_review

Ministerie van Infrastructuur en Waterstaat. (2019, March 26). From a linear to a circular economy. Circular Economy | Government.Nl. https://www.government.nl/topics/circular-economy/from-a-linear-to-a-circular-economy

Supply chain management in the era of circular economy: the moderating effect of big data | Emerald Insight. (2020, September 3). Emerald.Com. https://www.emerald.com/insight/content/doi/10.1108/IJLM-03-2020-0119/full/html

-

Manufacturing Strategies Explained.

Understanding the concept

According to ModusLin e-business and CRM leader, Johannes van den Berg, “Having your manufacturing strategy align with your customer’s needs and wishes creates synergy within a business. This results in increased production efficiency and growth as well as improved risk management and end-to-end improvements.”

There are many different manufacturing strategies that use aftermarket support and warehousing technology to improve distribution, customer experience, lead times, and warehouse operation.

At the core of successful supply chain management is warehouse and distribution management processes A report published by Comparative European Research titled ‘The growing importance of the synergy effect in a business environment perfectly explains the synergy concept. Synergy is a core element present in many successful manufacturing strategies and helps with meeting customer needs and demands.

It is a connection/interaction between different elements within a specific environment, creating or subtracting the additional value in the process. Improved tools and technology, such as digitization and automation, along with machine learning and AI processes, are all part of improving synergy within the supply chain network.

How does this relate to businesses today and improved supply chain and direct distribution services? Let’s find out!

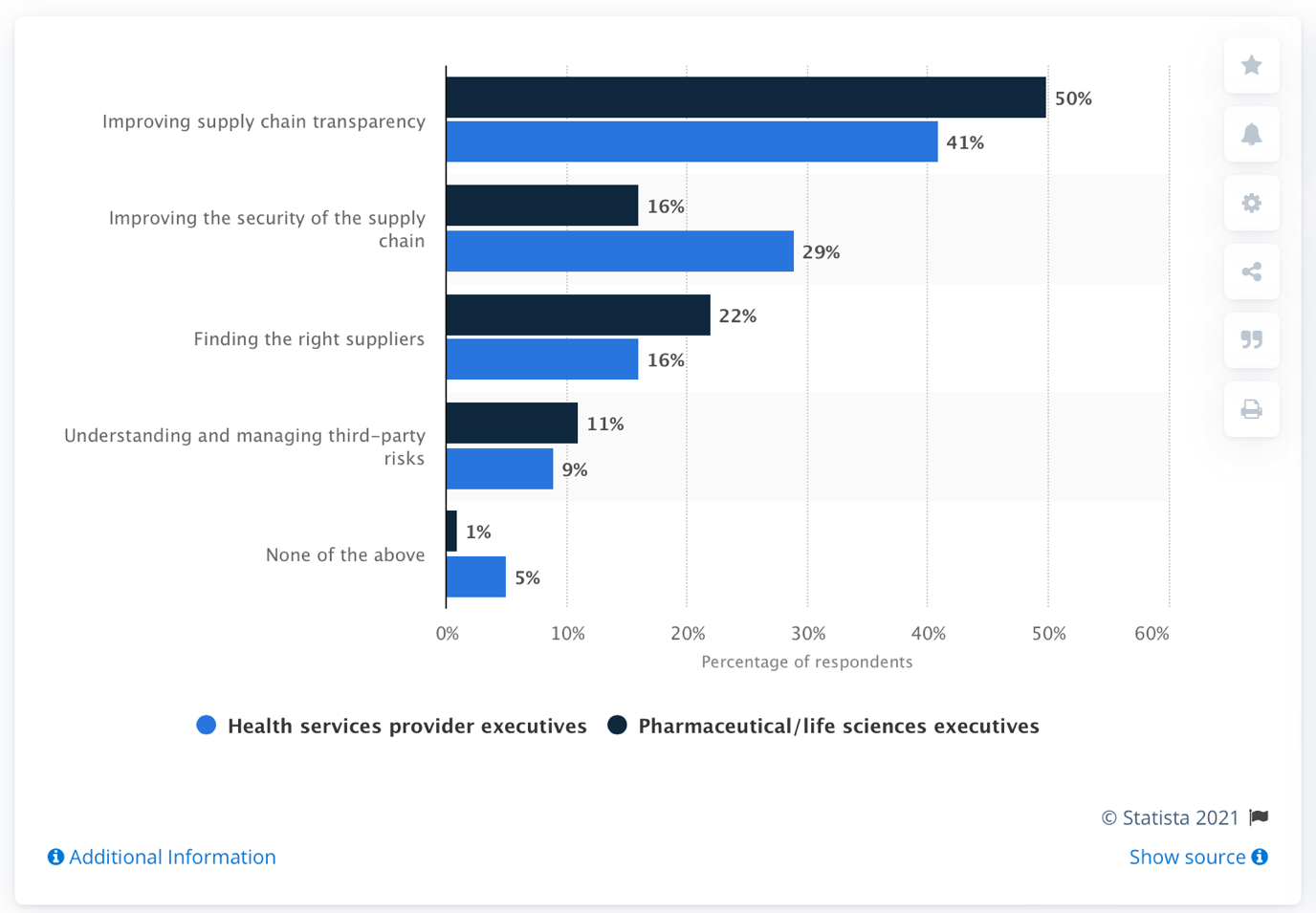

Warehouse and Distribution Strategies Explained

The importance of a proper manufacturing strategy and aftermarket support approach are indisputable. The three main Supply Chain priorities reported by U.S. health services providers and pharma/life sciences executives for 2021 are the improvement of Supply Chain transparency, improving Supply Chain security, and finding suitable suppliers (Statista, 2021).

The three elements relate to manufacturing strategy. Close contact with your supplier of raw materials is necessary when implementing the above manufacturing strategies. Reinforcement of supplier relations plays a crucial part in direct distribution, route management, and supply production processes.

Managing inventory properly using principles as JIT reinforces security within your Supply Chain and consequently can increase transparency when closely involving your suppliers.

Figure 1. (Top Supply Chain Priorities 2021) Statista. (2021, January 26). Supply chain priorities of U.S. provider and pharma/life sciences executives 2021. https://www.statista.com/statistics/1196032/supply-chain-priorities-health-services-provider-and-pharma-executives/

Different Strategies for Improved Aftermarket Support and Direct Distribution

Managing warehouse and distribution, supply chain logistics, supply lines, and shopping modes and trends are essential to improving distribution and support. It is easier to avoid issues such as supply chain attacks and weaknesses with the right strategy in place.

Here are three key strategies omnichannel supply chain management teams can use to improve aftermarket trends and demand forecasting methods today:

- Make to Stock (MTS)

This strategy is prominent in many businesses as it utilizes traditional production based on demand forecasting. Companies choose this manufacturing strategy because of the predictable demand forecasting that comes with certain products. For instance, winter coats are known to be purchased during winter, increasing the demand predictability.

Companies can thus safely create and stock winter coats before they are purchased. Unpredictable demand does not incentivize this strategy, as excess inventory can accumulate significant problems. Aftermarket support becomes easier and more straightforward and benefits customers and managers alike.

- Make to Order (MTO)

Some companies that use this strategy put manufacturing on hold until an order is received, minimizing stock levels. This strategy provides strong inventory and market control and aids managers in trend projection and the protection of sensitive data from clients and third parties.

A constant and minimal stream of orders must be present to maintain the production facility in question. Customer waiting times are also significantly longer (TheBusinessProfessor, n.d.) and can be impacted by warehouse and distribution and supply chain tools and tech.

- Make to Assemble (MTA)

This strategy involves the making of product parts before orders are received. The MTA strategy is a combination of MTO and MTS manufacturing strategies. Here product parts are stocked, yet the final product is assembled only when an order is placed and processed.

This strategy is often seen in restaurants as ingredients get prepared beforehand. Yet, the final dishes are assembled only when an order comes in to keep the dish fresh and flavorful.

No matter the inner workings, these three strategies play an integral role in supply chain management and direct distribution today.

Improve Warehouse and Distribution Performance With Help From ModusLink

The MTS, MTO, and MTA manufacturing strategies form the core strategies used by most businesses. These strategies are built upon principles such as the Just-In-Time (JIT) approach that focuses on eliminating waste by ensuring minimal stock levels are held through (party) automated product reordering systems.

John Heffernan, Chief Supply Chain Officer at ModusLink believes, “maximizing the efficiency of your manufacturing strategy is of high importance as it will yield waste reduction and a more streamlined production process, optimizing your supply chain.” And, it’s true; improving warehouse management, manufacturing strategies, direct distribution, and aftermarket customer support are critical to ongoing growth and recovery today.

Need professional advice on the right manufacturing strategy/optimization? Looking for ways to improve aftermarket support and internal distribution and management processes? Contact one of ModusLink’s Industry experts today.

Bibliography:

Comparative European Research. (2016, October). The growing importance of synergy effect in business environment(No. 1). Sciemcee Publishing. https://www.researchgate.net/publication/315657493_The_growing_importance_of_synergy_effect_in_business_environment

Manufacturing Production. (n.d.). Investopedia. Retrieved August 27, 2021, from https://www.investopedia.com/terms/m/manufacturing-production.asp

TheBusinessProfessor. (n.d.). Manufacturing Production (Strategy) – Definition. The Business Professor, LLC. Retrieved August 27, 2021, from https://thebusinessprofessor.com/en_US/business-management-amp-operations-strategy-entrepreneurship-amp-innovation/manufacturing-production-strategy-definition

Statista. (2021, January 26). Supply chain priorities of U.S. provider and pharma/life sciences executives 2021. https://www.statista.com/statistics/1196032/supply-chain-priorities-health-services-provider-and-pharma-executives/

-

The Same-Day Delivery concept.

The Same-Day Delivery concept

The internet allows people to achieve instant gratification for things that they want. All you have to do is open a search engine such as Google and request the information you need. For most parts, you can get what you want within seconds thanks to advances in supply chain operations, delivery logistics, and supply chain digitization and automation.

This drive for instant gratification has been introduced in today’s fulfillment practices as the concept of ‘same-day delivery. Understanding the answer to “what is the omnichannel supply chain” often focuses on operations. These processes are essential to mastering modern supply chain and e-commerce.

What Are Omnichannel Supply Chains and Same Day Delivery Services?

Same-day delivery is used chiefly for online companies to increase their sales. Customers are willing to pay an extra fee to get their products as fast as possible. The main reason is that it narrows the gap between instant gratification and brick-and-mortar store shopping.

Embracing omnichannel supply chains can improve overall customer satisfaction, business performance, and profitability.

Effectively implementing this concept does, however, require a vast number of resources which results in large companies adopting this practice for the most part and leaving smaller companies behind as they gain a competitive advantage.

Leveraging advanced supply chain tools, advanced smart technology, and XPO Logistics freight tracking options can help improve end-to-end e-commerce performances.

With the rise in popularity of online shopping, e-commerce shipping, and M-commerce business, the need for reliable delivery services is more important than ever. As more people begin looking at online platforms and using eBay, Etsy, Amazon, and Shopify plus B2B features, the more these digital tools and processes are needed.

According to Marlin W Ulmer (Ulmer, 2017) and the EconoCourier website (EconoCourier, 2016), the same-day delivery concept comes with both advantages and disadvantages, which are listed and further clarified below.

Disadvantages of Same-Day Delivery for Supply Chains

A recent article published by Fulfillmentworks (Fulfillment Works, 2020) focused on the question of what is omnichannel supply chain operations and how they impact the network today? The study shows that there are three main disadvantages for both companies and consumers that correspond with the same-day delivery concept.

Same-day delivery can limit companies’ flexibility due to planning and order prioritization disruptions. Companies that don’t utilize the same-day delivery concept can adjust more efficiently in their fulfillment operations, such as re-routing, altering contents, canceling, and holding orders, to optimize their fulfillment strategy.

Companies that utilize same-day delivery do not have this flexibility, as changes within the fulfillment process will result in delays, which can upset consumers who paid for the same-day delivery option (Fulfillment Works, 2020).

Efficiency is a critically important factor within all fulfillment operations. A powerful way to improve the efficiency in shipping is to group or batch orders, also known as consolidated shipping, as this can reduce travel times.

Same-day delivery limits the possibility of grouping orders as there is less time available to accumulate charges in your picking queue before the rankings get processed.

Some M-commerce companies avoid a same-day delivery concept as the inherent nature of the concept offsets their sustainability practices. 92% of consumers are more likely to trust companies that support social or environmental issues (Fulfillment Works, 2020). This means that your brand’s perception may improve its reputation more than same-day shipping.

Advantages of Same-Day Delivery for Supply Chains

Utilizing the same-day delivery concept allows companies to gain a competitive advantage over other companies that do not use this concept. Research shows that consumers want to get their products as fast as possible. This reinforces the statement of gaining a competitive advantage using the same-day delivery concept.

Companies that utilize same-day delivery see a reduction in their inventory costs. This is because they can reduce the stock warehouses held for retail stores and also improve cross-border logistics.

According to EconoCourier (2016), companies that offer same-day delivery also require their customers to pay an extra fee to realize this concept. This is mainly due to the additional costs associated with the abrupt same-day delivery request. Consumers that need a specific product fast can use the idea of same-day delivery and reduce the time it takes before they acquire their product.

This means they can reduce the time spent before they receive gratification by obtaining their product (EconoCourier, 2016). There are plenty of indications that same-day delivery will become an even stronger standard in today’s fulfillment practices since companies that do not apply this concept lose their competitive advantage.

Understand Same-Day Delivery and Omnichannel Services With ModusLink

ModusLink is ready to help you understand what it would take for you to be able to implement same-day delivery. We can analyze where you do business and want to do business and give you proposals as to the best approach, whether it’s a “universal” same-day offering, a geographic dependent same-day offering, or some other fulfillment as service criteria.

Bibliography:

Umer, M. (2018). Dynamic pricing and routing in Same day delivery. Informs, 1-2.

Ulmer, M. (2017). Delivery-deadlines in same day delivery. Logistics research, September. From inventoryops: https://www.inventoryops.com/articles/same_day_shipping.htm

EconoCourier (2016, December 22). The advantage of same-day delivery to businesses and shops. From Econo courier blogpage: https://econo-courier.com/advantage-day-delivery-businesses-shops/

Fulfillmentworks. (2020, June 10). The disadvantages of same-day delivery. From Fulfillmentworks home: https://www.fulfillmentworks.com/blog/post/disadvantages-of-same-day-shipping/

Clarkec, I. D.-P. (2020). Same-day delivery with drone resupply. Informs, 1-2.

DHL, T. R. (2019, May 16). DHL . From DHL launches its first regular fully-automated and intelligent urban drone delivery service: https://www.dpdhl.com/en/media-relations/press-releases/2019/dhl-launches-its-first-regular-fully-automated-and-intelligent-urban-drone-delivery-service.html

EHang. (2021, January 29). EHang home page. From EHang: https://www.ehang.com/ehangaav

CNBC. (2019, July 15). How Amazon delivers on one-Day shipping .

Geekwire. (2016, December 22). How does amazon prime now deliver packages in under two hours?

-

How to effectively control your transport costs.

Introduction