-

Importance of Payment Service Providers (PSP)

Customers want flexibility and choice of payment processors where possible. This is especially true when looking at business transactions and managing merchant accounts as a cross-border e-commerce shipper.

Generally speaking, the more payment types, rather mobile payment or even with virtual cards, boosts customer experience. And in turn, it means that it’s more likely a customer will complete the transaction. An August 2022 press release detailing the upcoming global decline of cash payments shared that “Cards and digital wallets are the most common payment instruments in most regions worldwide. Digital payments in the Asia-Pacific region accelerated, with China being one of the frontrunners toward a cashless society.”

Important, strategic choices have to be made regarding what payment service provider (also known as merchant of record) to use. Looking at an online payment transaction from the front-end is one thing, but, what about the other side, including direct bank transfers accounts or refunds and chargebacks? How do you choose the right merchant of record (MOR) and what differences do they offer? This article will cover the basics of payment services providers and what to look for.

What is a Payment Service Provider?

Payment service providers connect merchants to more extensive financial systems. This enables companies to accept certain payment types from their customers. Some typical payment options include card transactions, Apple Pay, and more.

Thus, payment service providers create a straightforward paying experience for the seller of record and their customers. In essence, the right MOR pay model is crucial to keep e-commerce businesses running behind the scenes.

Key Characteristics of Quality PSP MOR Pay Type

Besides simplifying the payment process, working with such companies and service providers yields these additional benefits:

- Automation – Payment service providers function as the process operator for your customers’ transactions, using automation along the way. This saves your resources and time, and in turn, streamlines your transactional process. Well-known payment types and popular service providers, such as PayPal, Venmo or Zelle, also enable automated recurring transactions for monthly subscriptions.This removes much administrative and operative work that otherwise went into completing these multi-currency transactions manually, especially for repeat purchases within MOR pay types.

- Reliability and Issue-resolving – A large and experienced merchant of record typically provide guarantees of service and are usually seen as more reliable. They often work to reduce missing revenue following unsuccessful payments or resolve problems themselves. Disputes are handled by the payment service providers which again, contributes to your resource efficiency as you do not need to handle any MOR pay sticky situations yourself.

- Transparency and Clear Communication – Most payment service providers are also fully transparent. Their complete clarity in all activities combines with straightforward communication. More visibility helps build a strong and reliable relationship with the seller of record. Plus, they often provide 24/7 support meaning that issues can be resolved quickly, should they arise. Customers in turn should expect minimum downtime and are less likely to bounce before completing their order.

Now that you have insight on some of the key benefits of using a a particular payment type and service provider, you might ask yourself, why shouldn’t I use one?’

Of course, everything comes with downsides or costs. Payments service providers usually charge you a fee per transaction. Some payment gateways might even charge additional fees such as initial partnership fees or just a monthly fee.

Payment service providers help contribute to business reliability and flexibility. Remember that the benefits of using a well-known, professional payment service provider outweigh the cost or investment needed.

Innovations

The financial technology industry is rapidly growing and resulting in the introduction of many innovative payment solutions. Customer payment types preferences are also changing. Everyone from seller to consumer and the merchant of record and seller of record is impacted by these changes.

For instance, there is a clear increase in completed mobile, contactless, or cryptocurrency-based transactions. Even ‘buy now, pay later’ is now mainstream, and it all indicators industry-wide growth.

Streamline Your Payment Types and MOR Pay Compliance With ModusLink

It is important to keep track of the newest and most popular developments in the payment world. Keeping up means you know how to maintain a competitive advantage, and in fact, many businesses often seek external professional advice to maximize the efficiency of their MOR pay networks.

Would you like to know more about how your Business can improve by staying up to date with the latest innovations regarding payment types and payment service providers? Talk to a ModusLink Expert today by clicking here!

Bibliography

(August 2022) Global Online Payment Methods 2022 . yStats GmbH & Co. KG, Accessed October 11, 2022, From https://www.researchandmarkets.com/reports/5441234/global-online-payment-methods-2022

R-07_How e-commerce has changed CRM

Fibontix. (2022, 9 januari). Top Payment Service Providers | Key Factors & What to Expect. Fibonatix. Geraadpleegd op 11 februari 2022, van https://www.fibonatix.com/resources/what-to-look-for-top-payment-service-providers/

Innovative Payment Solutions Across the FinTech Landscape. (2022, 7 januari). FinTech Magazine. Geraadpleegd op 11 februari 2022, van https://fintechmagazine.com/digital-payments/innovative-payment-solutions-across-fintech-landscape

The Top 11 Online Payment Service Providers in 2021. (2020, 27 november). WildApricot Blog. Geraadpleegd op 11 februari 2022, van https://www.wildapricot.com/blog/online-payment-services#save-you-lots-of-trouble

What Are Payment Service Providers? – Insights | Worldpay from FIS. (z.d.). FIS Global. Geraadpleegd op 12 februari 2022, van https://www.fisglobal.com/en-gb/insights/merchant-solutions-worldpay/article/what-is-a-payment-service-provider

-

Fulfillment-as-a-Service

Life at the most basic level is all about progress and growth. The forward path through time is key to everything done from the moment we are born till the day we die. This forward growth is also key for businesses of all sorts engaged in B2C fulfillment and B2B fulfillment endeavors. It comes down to effective digitalization and automation approaches to fulfillment services. Working with B2C customers and B2B shipment clients is integral to the daily operations of shipping service providers today, but growth means that outsourcing is sometimes necessary. That’s where fulfillment-as-a-service (FaaS) has come into play.

FaaS is where companies partner with a third-party company or warehouse to prepare and ship B2C and B2B orders. This allows a company to tap into fulfillment partner capabilities with no upfront investment of capital, and only pay for services that are needed and actually utilized with global fulfillment.

For any business to grow and scale, it must find ways to improve and optimize, even at peak moments. This usually means businesses are looking for ways to gain a competitive advantage within their current market. A highly attractive way of gaining such competitive advantage is by outsourcing part of your activities that are highly resource intensive. This makes outsourcing fulfillment a great option to look at for many businesses that are looking to scale (Busby, 2019).

B2C Fulfillment Success: It’s All Analyze – Optimize – Grow

The main reasoning behind the attractiveness of outsourcing fulfillment is that the order fulfillment concept is broad and widespread. This essentially means that the number of areas of potential improvement is usually high. By outsourcing fulfillment and effectively acquiring ‘Fulfillment as a Service’ businesses can gain a strong competitive advantage within the e-commerce and global commerce markets. The well-known optimization process Analyze – Optimize – Grow, is highly applicable here. Companies that are looking to outsource their B2B fulfillment process and seek help with B2C fulfillment should follow these steps in order to do so effectively (Thill Inc., 2021). Here is what each of these steps looks like in fulfillment solutions and ecommerce fulfillment processes:

1. Analyze

As mentioned before, outsourcing Fulfillment is highly popular due to the main potential areas of improvement. In order to get the best results up front, a strong analysis has to be made that identifies key areas of improvement in the Fulfillment process. This, for instance, could mean a detailed lead time analysis, a performance courier report, a return efficiency overview, etc. Professional supply chain experts often provide their insight before working with their potential partners. This allows the cooperation to flow smoothly and allows expectations to be met. Once the key global fulfillment areas of fulfillment as a service improvement have been identified, the actual optimization commences.

2. Optimize

The optimization process of course changes depending on the area that requires CRM optimization. The main red line within the process is often the same. Professional fulfillment experts that hold up-to-date knowledge of the current fulfillment innovations are often very able to implement disruptive measures to drastically improve the Fulfillment process for businesses. The best fulfillment companies make use of the most innovative technologies such as IoT (Internet of things) e.g., temperature sensors for Cargo loads, AGV (Automated Guided Vehicles) to maximize warehouse efficiency. Common but effective measures are also often implemented such as a more effective returns process, or the implementation of a ‘same-day delivery fulfillment’ option.

3. Grow

The most important indicator of successfully outsourcing your fulfillment process is of course continuous and stable growth. Outsourcing your fulfillment process should effectively reduce your resource utilization rate and improve the efficiency of your overall business as you are able to focus on other internal aspects. Evaluating periodically will result in a better partnership and will ensure that expectations are met accordingly. An important thing to keep in mind is that knowledge and insight of professional fulfillment companies should always be considered. A small ‘bump in the road’ can often be overcome by staying with the partner in question and keeping the partnership alive.

Key Benefits of Successful FaaS

There are plenty of benefits that come with outsourcing your fulfillment services. One of the greatest is the far-reaching impact supply chain tools have on the industry.

A couple of additional benefits of a global fulfillment approach to fulfillment as a service are mentioned below.

- Cash flow optimization – Handling fulfillment services internally can potentially require a high investment cost. Warehouses need to be rented, customer service staff must be hired, trucks and other moving vehicles have to be purchased etc. Making use of a fulfillment provider essentially turns these fixed costs into variable costs as the costs often scale with products/sales moving through the Supply Chain. Making use of a fulfillment provider can often impact your cash flow substantially by increasing the cash in hand and reducing fixed costs.

- Tap into new markets – Looking for competitive advantage will always be a key element that businesses decide to focus on as it yields them the opportunity to outpace competition. The cycle is simple yet highly effective. Fulfillment as a service increases your resource effectiveness by reducing resource intensiveness, in turn allowing you to allocate your resource in a different manner. This opens up doors to diversify by tapping into new markets that provide you new prospects.

- Expertise results in lower costs – Costs are almost always going to decrease when making use of a professional Fulfillment service provider. This has many reasons behind it. An example would be bulk transport contracting. Some Fulfillment experts make use of their connections which yields them cheaper transportation fares due to bulk consolidation with other loads/companies. In the Transportation sector, volume often means cheaper pricing per kg. Professional fulfillment companies often know exactly how to leverage this concept which results in cheaper transportation prices overall, thus reducing your costs.

Maximize Global Fulfillment With ModusLink

When businesses need help with fulfillment services, whether that is B2B fulfillment or B2C fulfillment, taking an ‘as a service approach is proving to be effective. With current levels of demand and customer impacts, industry leaders need to partner with a service provider who understands the market trends and consumer demands. Supply chain party logistics concerning B2B and B2C orders is easier with expert insight and guidance. Contact ModusLink today to learn more about customer expectations and B2B fulfillment services from start to finish.

Bibliography

Busby, A. (2019, 24 oktober). Fulfillment As A Service, Why The Future Of Delivery Is In The Clouds. Forbes. Geraadpleegd op 26 februari 2022, van https://www.forbes.com/sites/andrewbusby/2019/10/23/fulfillment-as-a-service-why-the-future-of-delivery-is-in-the-cloud/?sh=6b83309d4af1

business.com editorial staff. (2014, 25 juni). Benefits of Using an Order Fulfillment Service. Business.Com. Geraadpleegd op 2 maart 2022, van https://www.business.com/articles/benefits-of-using-an-order-fulfillment-service/

Roggio, A. (2011, 4 november). 5 Reasons to Consider Fulfillment Services. Practical Ecommerce. Geraadpleegd op 5 maart 2022, van https://www.practicalecommerce.com/5-Reasons-to-Consider-Fulfillment-Services

Thill Inc. (2021, 21 oktober). Fulfillment Center Pros & Cons. Thill Inc. Geraadpleegd op 5 maart 2022, van https://thillinc.com/blog/fulfillment-center-pros-cons/

-

What are Merchant of Records (MOR)

New and startup businesses and shipping service providers often struggle to generate growth and maintain a competitive advantage. With the ever-changing market trends and consumer demands, it is difficult to manage merchant relationships and processes. Successful scalability begins with the help of outsourced omnichannel services, including outsourcing the Merchant of Records (MOR).

That’s especially true with multiple contracts and partnerships involved. However, as the business type and demands grow, change becomes inevitable, and overall management gets more complex.

Scaling effectively requires a new approach to operations management and fulfillment partner selection. Businesses that can scale accordingly often show activities that are indicative of correct resource allocation and optimization.

There are plenty of ways to enable supply chain optimization. Some options include:

- Optimized inventory planning.

- Well-designed Customer Resource Management (CRM) software.

- Robust marketing strategies and more.

Businesses use a variety of these tools to unlock growth. Establishing an outsourced MOR contributes to the improvement of omnichannel 3PL services within businesses. But, it’s best to start by asking, “what is a Merchant of Records?”

What is a Merchant of Records?

Excessive growth often comes naturally with extra work. For instance, consider the added complexity as the following processes grow:

- Payment processing and handling grow more complex.

- More payments, chargebacks, and refunds need to be processed.

- Tax documentation complexity increases every year.

- Pricing negotiation becomes more difficult with each partnership.

All this work requires extra assessments and better resource management processes. Leveraging outsourced omnichannel services simplifies things.

Companies must use new and improved supply chain tools or CRM platforms. Still other opportunities to simplify exist.

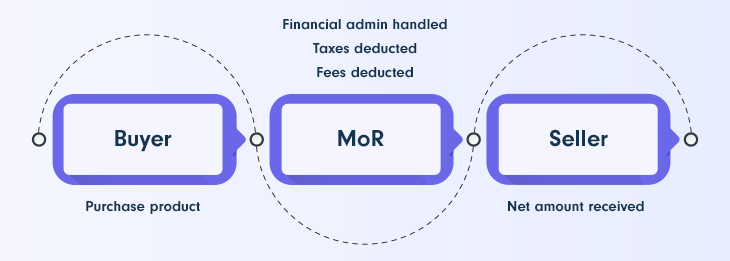

Companies can be their own merchant of record, but they can also outsource this work to entities. These third-parties sell goods or services on behalf of a business and, by doing so, take on the liability related to the transaction (Collier, 2021). Working with a 3PL company that offers omnichannel services can improve your processes and increase your productivity.The Merchant of Records helps you stay focused and unlock resource efficiency. Together, outsourced financial services create better growth generation. Meanwhile, omnichannel fulfillment, customer interaction, contact management and other processes continue uninhibitedly.

Of course, outsourcing omnichannel 3PL services, including MOR, creates scalability for any business entity and is continuously improving customer support. The MOR essentially relieves the burden of performance on all payment activities.

Well-established merchants of records provide complete transparency at all times. See the picture below for a simplified visual of the MOR and outsourced omnichannel process.

Figure 1. Merchant of Records visual)

As scaling is often difficult for many companies, lifting the burden of financial operational responsibility through outsourcing a Merchant of Records is critical. It enables an increase in focus and commitment that in turn, strengthens scaling and growth. According to a report on omnichannel 3PL company services by Fortunly (2022), 71% of financial service executives outsource or offshore some of their services. Meanwhile, 78% of businesses all over the world feel positive about their outsourcing partners.

Further statistical research suggests that the outsourcing market for financial services will only continue to expand. Changes will remain a constant as time goes on and recovery from COVID-19 disruptions continues.

Figure 1. Merchant of Records visual) https://blog.payproglobal.com/what-is-a-merchant-of-record

Tapping Into New Markets With Improved MOR Services

Outsourcing a Merchant of Records enables better internal resource management. Outsourcing grants efficiency to tap into new markets. This allows them to expand their customer base.

It can also help improve supply chain responsiveness as scalability and adaptability also improve. According to Wunker e.a. (2011), one of the greatest contributing factors of success to any business is a company’s ability to capture new markets.

This can be related to new products, customers, industries etc. Tapping into new markets is a great way to generate additional sources of profit and gain a competitive advantage for any omnichannel 3PL company.

Merchants of Record outsourcing services also analyze market financial data. In turn, they provide a highly detailed action plan. Thus, you can better track, analyze and evaluate your operations. The value of the Merchant of Records applies across both forward and reverse logistics.

Improve Outsourced Omnichannel Services With ModusLink

As mentioned before, many successful businesses outsource at least part of their financial operational activities to optimize their practices. Would you like to know more about how your business can implement a professional Merchant of Records? If you have questions about these services and how to maximize your impact as an omnichannel 3PL company, talk to a ModusLink professional today to get started with improved MOR services and enhanced CRM solutions.

Bibliography

Fastspring. “What Is a Merchant of Record (And Why Should You Care?)”. FastSpring, 23 december 2021, fastspring.com/blog/what-is-a-merchant-of-record-and-why-you-should-care.

Fortunly. “15 Must-Know Outsourcing Statistics for 2022”. Fortunly, 9 februari 2022, fortunly.com/statistics/outsourcing-statistics/#gref.

—. “15 Must-Know Outsourcing Statistics for 2022”. Fortunly, 9 februari 2022, fortunly.com/statistics/outsourcing-statistics/#gref.

Mansfield, Dani. “What is a merchant of record en why use an MoR as a solution for payments?” Paddle, paddle.com/blog/what-is-merchant-of-record. Geraadpleegd 9 februari 2022.

Meir Amzallag. “What Is A Merchant Of Record: How Does MoR Cut eCommerce Risk?” PayPro Global, 23 november 2021, https://blog.payproglobal.com/what-is-a-merchant-of-record.

Suess, Emily. “4 Tips for Growing Your Business by Tapping Into New Markets”. Small Business Bonfire, 2 januari 2013, www.smallbusinessbonfire.com/new-markets.

Wunker, Stephen, e.a. “Achieving Growth by Setting New Strategies for New Markets”. Ivey Business Journal, 13 februari 2015, iveybusinessjournal.com/publication/achieving-growth-by-setting-new-strategies-for-new-markets.

—. “Achieving Growth by Setting New Strategies for New Markets”. Ivey Business Journal, 13 februari 2015, iveybusinessjournal.com/publication/achieving-growth-by-setting-new-strategies-for-new-markets.